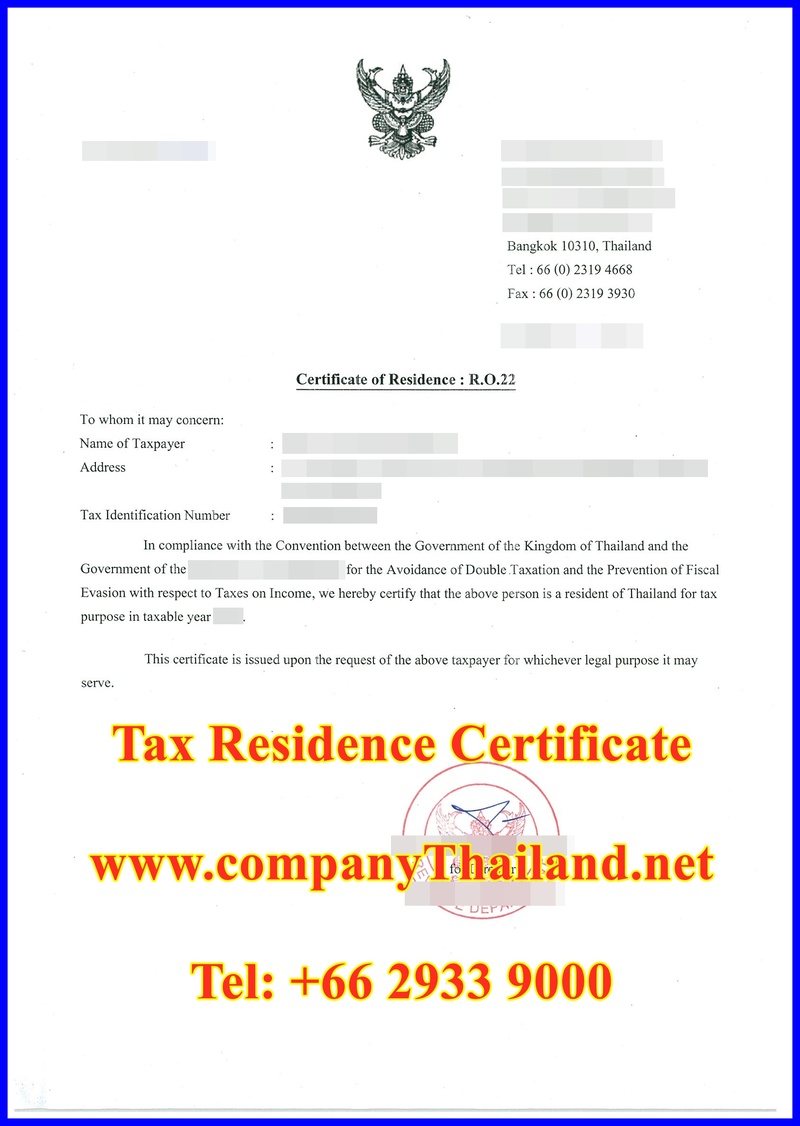

Tax Residence Certificate, Certificate of Residence in Thailand for Tax purpose.

To avoid of Double Taxation and Prevention of Fiscal Evasion with respect to Taxes on Income, Thai Revenue Department are welcome to issue “Certificate of Residence”. Panwa has services to be a representative to ask this certificate at below step:

- Step 1. At the Immigration Bureau, do a searching result for entering and exiting of Kingdom of Thailand to prove that you were longer stay than 180 days during that year.

- Step 2. At the Revenue Department, to issue the “Tax Residence Certificate”.

Service Fee is Baht 15,000

Conditions

- The applicant must reside in Thailand for at least 180 days.

- The applicant must sign the documents in Thailand and present a valid (non-expired) visa.

- A taxpayer identification number (TIN) is required.

- The applicant must have previously paid personal income tax in Thailand – Note 1.

Note 1 – Although there is no require tax payment in Thailand in order to request a Tax Residence Certificate (TRC), the criteria set by each local Revenue Department Disttrict generally require applicants to submit a copy of their personal income tax return along with the official tax payment receipt as supporting documents.

It is also important to note that if you reside in Thailand and bring income into the country — regardless of the tax year in which the income was earned — if the funds are remitted (brought) into Thailand from January 1, 2024 onward, you are required to pay tax in Thailand in accordance with Revenue Department Orders No. Por. 161/2566 and Por. 162/2566, refer to Section 41, paragraph 3 of the Revenue Code.

Other and related services

- Apply TIN (Tax Identification Number) in Thailand – click here

- Certification or authentication for TIN, Tax Residence Thailand by Certified Public Accountant (CPA), by Accountant or by Lawyer.- click here

- Tax planning for foreigner residents in Thailand – click here.

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th (Mr. Tana Sipa)

WhatsApp: +66 81 919 6225

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.

Q & A

Q1 : I’m currently working in Thailand. I have applied for Tax residency certificate for year 2022 to use in my home country, Japan. Moreover, I am also US resident and I also need the tax residency certificate to present in US Government. In this case, can I use the same tax residency that I previously applied for Japan?Panwa: No, the tax residence certificate cannot be used in other countries, due to on the certificate, it will show the detail of the country that you will use such certificate and the government allows to issue 1 country per certificate. Please note that if you need the tax residency certificate to use in US, you need to apply a new application. |

Q2: Can I obtain a TRC without paying any income tax in Thailand?Panwa: |

Q3: Is a TRC automatically granted if I stay in Thailand for more than 180 days? |

Q4: Do I need to have a work permit or Thai employment to apply for a TRC? |

Q5: Can I use a retirement visa or LTR visa to qualify for a TRC? |

Q6: if my income is solely from overseas and not remitted to Thailand—am I still eligible? |

Q7: Can I authorize someone to apply for a TRC on my behalf? |

Q8: Which Revenue Office should I apply to—can I choose or is it based on my address? |

Good Day

I need tax residency certificate here in Thai. I am a pensioner and I need it to request the cancellation of taxes in Italy

I remain available.

Whatsapp +660803944xxx

Line 0803944xxx roberto

Im pensioner

Thank you for contacting, our team will communicate with you via whatsapp within 2 hrs, normally you mush have TIN in Thailand then you file PIT in Thailand then you can apply for “Tax Residency Certificate”. Therefore in detail will be explained by our team. thank you.

Good day

I have been asked to provide a residence tax certificate by my pension provider. My pension is held in Malta and is qorops registered in uk.

My pension is less than 1million and I have not completed a tax return.

Please can you help

Sir, in order to get Thai tax residence certificate you must have Thai TIN number then file PIT (personal income tax) return here in Thailand then you can start for it. If you need my team can support all step and finish within 1 month. Please email to bkk@panwa.co.th

Hello,

I would like to request a tax residence certificate – with your help – but regarding the stamps in the passport, I noticed that there is no more stamp AT EXIT (electronic doors) in airports in Thaîland.

How can I therefore prove my 180 stay in the country ?

Thank you

Eric Sciacca

Thank you sir, we can get the report from immigration office to prove 180 days. In detail you call me via whatsapp at +66 81 919 6225 or email: bkk@panwa.co.th