Company Liquidation and Dissolution in Thailand, closing down company )

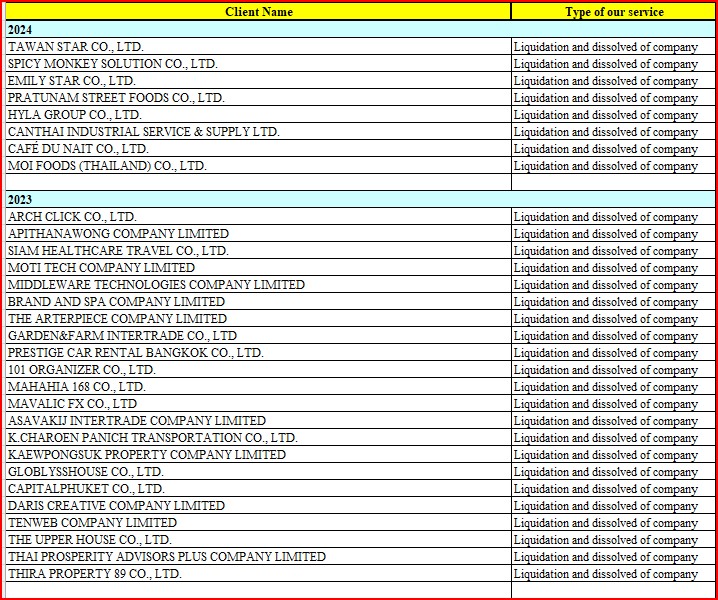

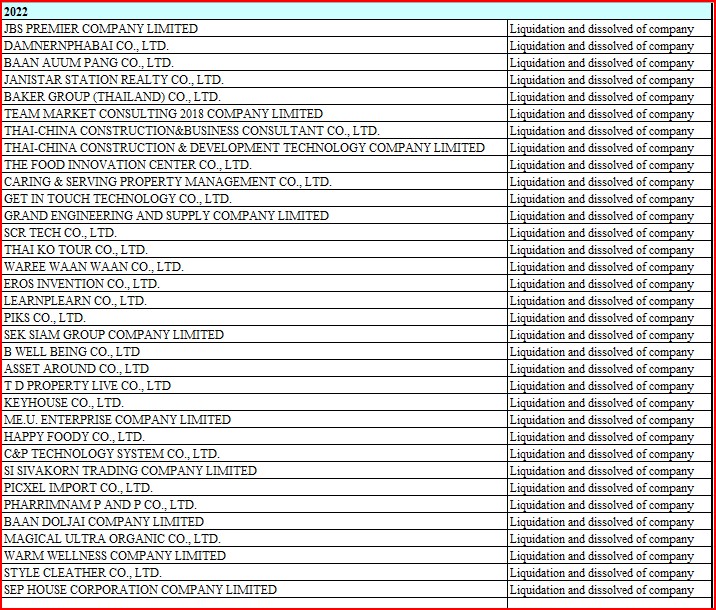

Panwa has been supporting clients with company closure services for over 20 years. Below are our service fees, process guidelines, timeline, and other key information for closing a limited company in Thailand.

Starting in 2025, closing a company in Thailand has become more difficult. The Revenue Department now delays all liquidation cases to check them carefully. In cases where the process extends beyond one year, your company is still required to file the 90-day report with the Department of Business Development (DBD). Panwa will charge an additional for any period exceeding one year, as appropriate.

Service Fee: is depend on 2 cases:

Case 1. Fee for closing dormant company or shelf company is Baht 45,000. Please see conditions and “Provision Cost” as below:

| Liquidation cost of dormant company – Dormant or Shelf company only. | Baht |

| Closing down registration to DBD and RD – Scope of Service refer to procedure step nos. 1,2,3,5,6,7 below (except preparation and audit of FS) – Our services include to be a representative to meet and declare company’s information to Government Sector free for 2 times. | 35,000 |

| Accounting, Auditing and Corporate Income Tax (Financial statement and auditing report provided in Thai and English) *** Case of active company please let us know more information. |

10,000 |

| Official fee and other expenses : – Government fee | 1,040 |

| Estimated Cost of advertisement in local newspaper (3 times) | 1,500 |

| Estimated Postage for invitation letter of the meeting (Sending 2 times; local is Baht 37 each, oversea Baht 125 each in Southeast Asia zone) |

300 |

| Total | 47,840 |

- Case of VAT registered company, monthly VAT return still be filed for estimated 6 months that can be filed by your side but if need our support we have some extra charge.

- In case the liquidation process is delayed and exceeds one year, a 90-day progress report must be filed with the DBD. We may charge an additional fee for every subsequent 90-day period.

Case 2: Small-sized company

- Our fee for closing an active company or a company that has previously done business is Baht 35,000. This covers items 1, 2, 3, 5, 6, and 7 listed below, excluding the preparation and audit of financial statements.

Case 3: Medium-sized company

- Our fee for closing an active company or a company that has previously done business is Baht 100,000. This also includes items 1, 2, 3, 5, 6, and 7 below, but does not include the preparation and audit of financial statements.

- Medium-sized company is define as annual income/ revenue more than Baht 50 million but not exeeding Baht 100 million.

Financial Statements and Audit

- For preparing financial statements and having them audited by a CPA (see step 3 below), the fee depends on the number of documents. Our accounting and auditing fees start from Baht XX,000. For a fixed quote, please send us more details about your company.

Procedure and Timeline

Our procedure will be finished within 1 month, below is the simple process and timeline of closing company registration.

| Timeline | Procedures |

| Jun 1 | STEP 1. To advertise in local newspaper and sending invitation letter for a shareholders meeting To comply with the policy of Thailand, one must send an Invitation Letter for a Meeting to the Shareholders with the agenda for closing of company. The letter must be sent to the shareholders by local post (with advise of delivery) and advertise in the local newspaper. This process will be taken effect within 14 days. Please note that this step is just to comply with the policy for closing of company. |

| Jun 15 | STEP 2. Registration for Closing of Company to the Ministry of Commerce (MOC). Once the process and all the requirements are completed, the MOC will release its confirmation of closing date of the company. The company must prepare its accounting until the confirmed closing date. |

| Jun 16 – 18 | STEP 3. To return the VAT Certificate (P.P.20) to the Revenue Department (RD). After the confirmation of closing date from MOC is obtained, the company’s VAT PP.20 must be returned to RD. This step must be done within 15 days from the obtained closing date as referred above; the original VAT certificate must be returned. Case of any delay, penalty is Baht 2,000. Please note that the company is still responsible to submit the VAT form every month until the RD released its confirmation letter accepting the cancellation of its VAT |

| Jun 28 | STEP 4. The company’s Financial Statements (FS) for the closing period (at Liquidation date) must be prepared and will be audited by a Thai auditor (CPA). And request the company’s liquidator to sign the financial statement and Corporate Income Tax Return and other documents for step 6 below. |

| Jul 1 | STEP 5. To file Corporate Income Tax Return (PND. 50) with enclosed FS to RD. The audited FS must be submitted to RD within 150 days from its closing date. |

| Jul 1 | STEP 6. Registration of completion of clearance documents to MOC with enclosed FS. |

| Jul 2 | STEP 7. To return Tax ID to RD. |

| STEP 8. VAT Cancellation approval from RD As mentioned in STEP 3, the company is still responsible to submit monthly VAT return every month until RD released its acceptance letter for VAT cancellation. Normally, RD will release the said letter within or earlier than 6 months from the date that VAT certificate is returned. |

Remark:

- Dormant Company means a company is inactivity (business); most of dormant company has purpose to standby for doing business.

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Email: bkk@panwa.co.th

WhatsApp: +66 81 919 6225 (Mr. Tana Sipa)

LineApp ID: @panwa

Address: 1560 Latphrao Rd., Wangthonglang, Bangkok 10310, Thailand.

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Sky train: Yellow Line, Chokchai 4 Station, Gate 4. Our office is located between Soi Latphrao 50 and 52.

Greetings,

We develop systems to serve more customers with reasonable fees.

Tana Sipa

Director and CPA

WhatsApp: +66 81.919.6225

Location: https://goo.gl/maps/MhJsbjkPrji51Qyt6

Documents Storage Service

We offers company-document storage solutions to companies that have been liquidated as well as companies still in operation.

Due to the fact that under Thai law liquidated and incorporation companies are required to keep all company documents as stated in the Accounting Act, B.E. 2543 (2000) for five years after the date of liquidation or closing of accounting period. read more…

We can help you for further:

- Documentation relate to terminate staff, office rental and etc.

- Meditor, cordinator and negotiator between your company and other party

- Manage to move all of your company’s assets

- Monitor your remaining assets here in Thailand with take photo sometime

- Storage your documentation and handling all matters with government sector including destroying

Further support relate to company liquidation

- Tax clearance, declaring and filling

- Close Bank Account

- Cancel all kind of licens

Q & A – Company Liquidation Thailand

Q1: Juristic Company had notified the company’s dissolution to registrar of DBD, Ministry of Commerce on November 15, 2015 but registrar issued the certificate specifying that the registration of the company’s dissolution was accepted on September 9, 2016, in this case, which date was the date of dissolution?Panwa: In case of the company’s dissolution, the date of dissolution is the date that the registration of dissolution is accepted by registrar under Section 72 of the Revenue Code. |

Q2: Accounting period can be over 12 months or not?Panwa: Accounting period over 12 months: the accounting period may be extended longer than 12 months for the case that juristic company or limited partnership is dissolved but liquidator and manager are unable to file tax return within 150 days from the last date of accounting period, and have submitted application to Director of Revenue Department within 30 days from the date that the company’s dissolution has been accepted by registrar, in this case, the Director of Revenue Department may approve the extension of period so this accounting period may be over 12 months. |

Q3: My company has obtained BOI privilege and now we plan to dissolve, can it be done same as ordinary company or has further step?Panwa: It’s not the same with ordinary company, the rough step and procedures are as below: Procedures for closing a company with promotional privileges 1. To dissolve the certificate with BOI before doing the step of company’s liquidation at The Ministry of Commerce (Department of Business Development)

Remark: the above requested documents are not official form therefore, the company which intents to dissolve must be created by themselves with specifying full content inside for clearness and completeness. 2. To do ordinary step of closing (dissolution) company as mentioned above (step 1 to step 7). 3. To dissolve the Foreign Business License (FBL) with Bureau of Foreign Business Administration Department of Business Development Ministry of Commerce within 15 days from closing date of registration.

|

Q4: We registered our company (in Thailand) on April 2016, til now (June 2017) we did not have any income yet, only the loss, we are liable to report to the Revenue Department for the first year?– Is the accounting period can be ended after December 2016 since the company had registered the accounting period on December of every year and we decide to close company now? |

|

Q5: 5.1 – We has a bank balance of Baht 10,080 in its books. Is the bank closure also forms part of your service when doing the liquidation?Panwa: To close bank account is not including in above package, but if needed by you, we also can propose by 2 options as below; a. We can arrange all paper and your director bring to bank by themselves, the fee is Baht 2,000. b. We can arrange all peper and our team will support at the Bank too, the fee is Baht 5,000 5.2 – If yes, are the Directors required to be present when closing the bank as well?Panwa: Yes, of course all bank signatory (signatory director) must be physically present at bank when closing the banks. 5.3 – Would it be better to close the bank first before we proceed with the liquidation?Panwa: Yes, better to minimize the account to be clousre before start to process the liquidation. |

Q6: If our company already close, do we need to still filing the VAT every month?Panwa: Yes, until the tax officer issue the VAT cancellation letter |

Q7: The company was registered last 2018 and did not file any financial statements to both DBD and RD. Moreover, last July 2019, the company was registered for close already. For this case, we are not sure if company need to pay any delayed penalties.Panwa: Yes, company need to pay delayed penalties at RD only, which are:

For DBD, there is no penalty, due to company was already registered for close. |

Q8: The company had already registered for close at DBD, but the step of company dissolution is unable to finished within due date of 3 months (after the date of closing company register), what should the company do?Panwa: The company has to report the liquidation (Lor. Chor. 3) to the DBD Registration office every 3 months, if not so your company has to pay penalty of Baht 2,000 for every 3 months. Anyway there is not limit of time for Lor.Chor.3 filing of every 3 months. |

Q9: I would like to find out if you can temporarily close a thai limited company with foreigner as director. Close for 3 months and then re-open?Panwa: No need to do for temporarily close a Thai limited company due to Ministry of Commerce and Revenue Department are not allow for that step, depend on you for VAT you can send the letter to inform Tax Authority in your area that you will stop business activities but even tough the letter is submitted you company still file monthly VAT too. |

Q10: I have had a company for less than one year (about 9 months) and have filed all the paperwork til now. I have also had a work permit and one Thai staff. The company has never had any revenue or business activity of any kind. Now the firm that set up the company wants 80,000 Baht to shut it down. I am wondering if I simply stop submitting paperwork to the government and don’t have any company activity if in three years the company will go defunct and I can avoid paying the 80,000 Baht. Or will I have some problems being in Thailand as a Director in a company that doesn’t file paperwork?Panwa: Your way to leave th company is not good, you may found the police summon letter and its penalty if the financial statement be not submit and also some fine from tax return for un-submission so better to clean up the company and find the good and cheap provider to close it.Firstly, you have to close social security fund, bank account and other related to this company also you have to clear up all liabilities of the company (return your work permit) and etc, so that your can reduce your current cost and will easier when step of closing down the company. If you proffer to leave the company as defunct, you as company’ director may found the Police Summon Letter and then being in court, for further information please look: https://www.panwagroup.

|

Q11: We have been operating our business in Thailand for nearly 10 years. However, our head office in Singapore has recently decided to cease operations and relocate all activities. As a result, we are now looking for a solution to efficiently wind down and close our business in Thailand as soon as possible. In the past, we engaged one of the Big 4 firms for audit and tax consulting services, but the high cost has become a concern. Therefore, we are seeking a more cost-effective alternative. If your firm has experience handling closures for medium-sized companies with annual revenue exceeding THB 100 million, we would appreciate it if you could propose a scope of work and share a brief overview of your relevant experience.Panwa: Welcome and tank you for a change for us to propose our scope, fee and abilities. We have a lot of experience for the subsidiary of foreign company in Thailand including foreigned owned companies. below is scope that we can serve that classy to be: A. Pre-Liquidation A1. PBL Cancellation ………………………………………….. ? B. Liquidation & Dissolution Step B1. Liquidation & Dissolution Registration at DBD ……. 100,000 Remark:

|

Greeting from the Author

Hi there Visitors and Prospected Clients,

First of all, your visit on our website especially this page “closing down company in Thailand” is very much appreciated. We do hope our information will be satisfied to you and will solve all of your queries; we try to summarize related knowledge, procedures, find the easy way and also the resolution to attain the completion of closing down company of yours here in Thailand.

The summary of procedure, timeline and knowledge for closing down company above is the rough information that can be applicable for small company size but for the medium – large size especially owned or managed by foreigner it really needs to set the plan for its liquidation (closing) and have to minimize remaining balance, clean up all problem of tax point before coming to closing period or at least closing registration date.

By the way, I can say that the closing company who is owned or managed by foreigner (or foreign company) is very complicated especially the step of checking by tax officer, although I have long experience in the field of auditing and tax advisor, I still find it confusing that some cases checked by officer using their own concept to apply tax checking is different with principal taxation law.

Before creating this webpage, as I am auditor and advisor, I’ve got a lot of queries and met many affected results from the unplanned process for closing down company and in-conversant foreigner into Thai Tax Structure and also liquidation law and regulations especially no plan on tax and accounting before closing, some of them close business with the effects on a huge tax amount and penalty and some still in the judicial process or leave their company (without complete of closing down registration). Whenever I heard these points, my feeling is so bad that’s why I tried to summarize this webpage for you who have endeavor to clean up all kinds of problem for closing down company.

As I am auditor who are very conservative in publishing information and try to set framework content for you to clarify on overall structures, some content and information are hardly to disclose and explain on this publication, in case you have further information or need to know in deep details of any matters related to setting up company in Thailand, you can contact me either via email at bkk@panwa.co.th or phone +66 2 933 6121 (to 2).

Best Regards,

Mr. Tana Sipa, CPA Thailand and Director

Personal profile

CPA License

Profile – 2024

Panwa Auditing License

—————————–