by panwa group | Feb 13, 2024 | 5.QA

Q; We require the services of a Certified Public Accountant (CPA) to provide a confirmation letter stating that, given his status and the conditions of his visa, Mr. XXX does not hold a Tax registration number in Thailand and he has no TIN in Thailand. Could you...

by panwa group | Jan 26, 2024 | 5.QA

Q: After I setting up the company, I have received the email from Social Security Office, informed that my company have the employer account number already which it means that I can start to hire the staff right? Panwa: Yes, you can start to hire staff. Please note...

by panwa group | Jan 25, 2024 | 5.QA

Can I open a corporate USD and multiple currency accounts at the same time with a THB account? If not, when can I open it? Panwa: Please note that it depends on each bank and branch’s policies which some bank they can allow to open the USD account in the same time...

by panwa group | Jan 9, 2024 | 1.Services

Tax planning for foreigner residents in Thailand Foreigners are required to file tax return in Thailand if they fall under the following conditions: Such foreign individual has an assessable income from oversea income source since January 1, 2024 onwards, in the tax...

by panwa group | Dec 18, 2023 | ไม่มีหมวดหมู่

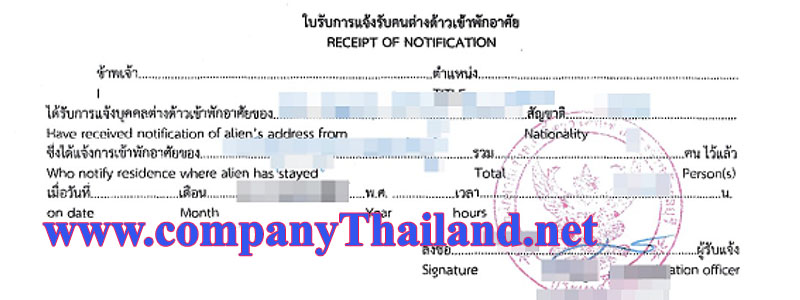

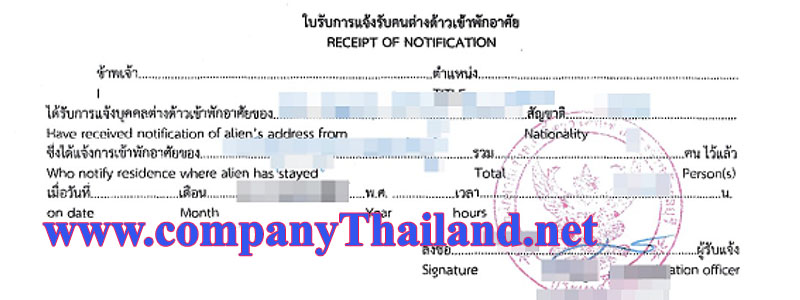

Notification of Residence for Foreigners issued by Immigration Bureau. The Notification of Residence or Resident Certificate must be done at Immigration Bureau....