Registered Accountant – Qualified Accountant in Thailand

(Thai chartered accountant, Qualified professional accountant services)

Under Accounting Act B.E.2543 and Accounting Profession Act B.E.2547, all juristic company, partnerships, branches of foreign companies and joint ventures are required to have qualified accountant to apply with the Ministry of Commerce on behalf of your entity especially when end of accounting period the said accountant still has responsibility to sign – endorse on Sor.Bor.Chor.3 Form (Financial Statement Submission Form) as same as director(s).

Below is Qualification and Condition for Accountant according to Accounting Act B.E.2543 and Accounting Profession Act B.E.2547.

General Qualification

- Have registered address in the Kingdom of Thailand

- Have sufficient knowledge of Thai language for accounting

- Have never been imprisoned by the guilty according to the accounting law or auditing law or accounting profession law, except they have been freed from the penalty for at least 3 years.

Educational Level

According to Size of Business identified;

- Bachelor of Accounting or equivalent for every type of business

- High Vocational Certificate (Accounting) or Diploma (Accounting) for company limited and registered partnership with

- Capital of not excess than 5 million Baht

- Total income of not excess than 30 million Baht

- Total Asset for not excess than 30 million Baht

- For ordinary person, if the owner of the business does not prepare the accounting by him / herself, he /she does not need to identify the educational level for accountant but if he / she employs other persons to prepare the accounting, the accountant must have the specified educational level.

Condition

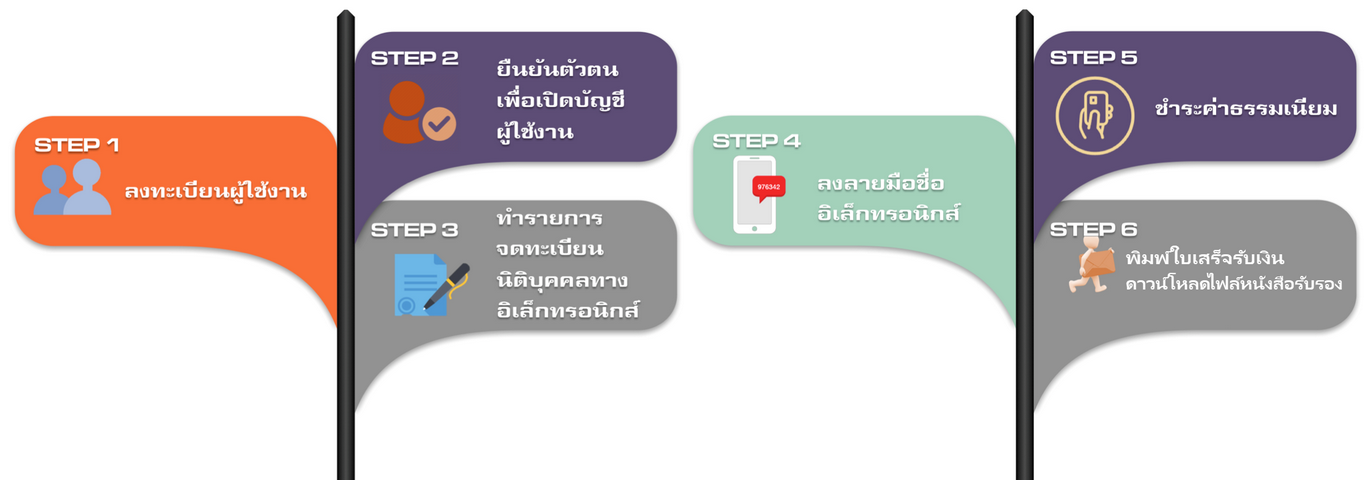

– Inform the details according to Sor.Bor.Chor. 5 Form or Sor.Bor.Chor. 6 Form within 30 days from the date that

– The accounting starts

– The accountant has been changed

– Train accounting knowledge as specified not less than 12 hours per year

– Must be a registered member of the Federation of Accounting Professions

– Must provide details of continuing knowledge development, and professional accounting via the electronic system at www.dbd.go.th within 30 days from the end of each calendar year.

Advantages when use Panwa’s Service for registered accountant.

- No need to worry about the resignation of your accounting staff.

- Saves time for preparing various related documents for new accounting staff

- Saves cost for apply to be a member of the Federation of Accounting Professions and annual training of accountant.

- Saves time for training and provide all of required information to the online system

Our service is Baht 5,000.

- Covering the above requirement and condition, if you need our support for Registered Accountant – Qualified Accountant please contact us below detail:

For more information, please feel free to contact us:

Phones: +66 2 933 9000

Whats'app: +66 81 919 6225 (Mr. Tana Sipa)

Email: bkk@panwa.co.th